Dr. Jeffrey Krug filed motions for additional fees totaling $1.6 million after a $4 million verdict in a wrongful termination suit. These fees include additional costs relating to the case, attorney fees, negative tax consequences on the front and back pay, and pre-judgment interest. These fees add up to approximately $1.6 million, bringing Krug’s awarded amount to a potential $5.5 million.

The breakdown:

Attorney costs and fees: According to motion statements provided to The Voice by Krug’s attorney, Pat O’Connell, the total attorney fees and costs incurred total approximately $1.2M. This total reflects the work of four attorneys and one paralegal, who all together spent over 2,300 hours on the case. It also includes the $16,728.80 in costs and expenses incurred during litigation.

Negative tax consequences of a lump sum award of front and back pay: When a plaintiff receives a lump sum award in a termination suit, that awarded number reflects compensation for the loss in wages since the termination. Oftentimes, the lump sum puts the plaintiff in a different tax bracket, which will force the plaintiff to pay more in taxes than if the money had been given over the span of several years. To prevent this taxation, plaintiffs file this motion to put the responsibility of paying the taxes on the defendant. Krug filed for $290,458.

Pre-judgment interest: Pre-judgment interest, which compensates the plaintiff for money lost before the judgment is finalized, was filed in the amount of $201,841. Additionally, a daily post-judgment interest in the amount of $480.72 per day was filed beginning Aug. 22.

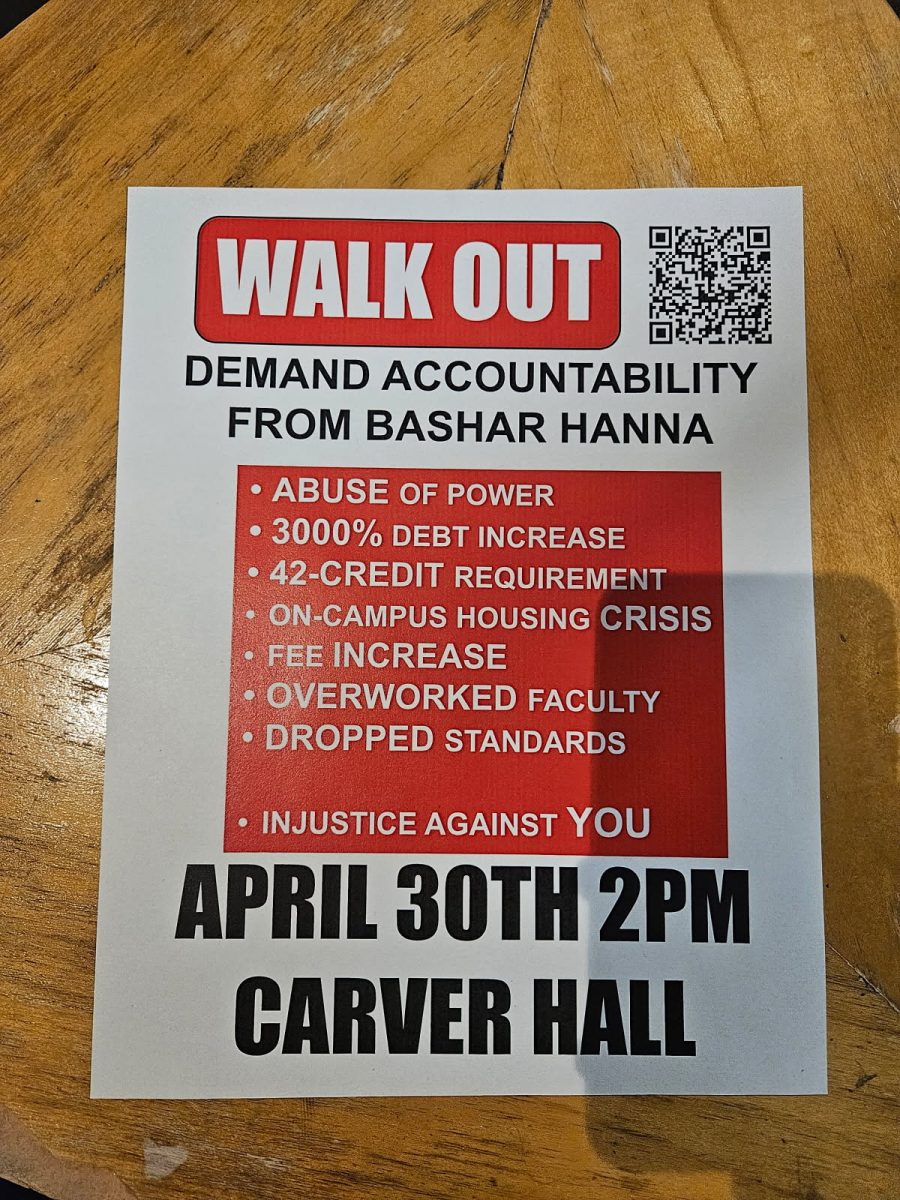

Dr. Hanna was reached out to for comment, but as of September 9th, had no comment on the matter.